In the last blog we talked about the evolution many organizations take as they approach the physical supply chain of their organization and identified the benefit of bringing the ‘value’ components of the supply chain back into the organization. This time we’ll look at how to begin that process and some of the benefits we might expect.

How Is The Hybrid Phase Achieved?

By bringing ALL the valuable business logic, sourcing, fallout, and billing event information back within the four walls of the organization, Any CSP can maximize the value of outsourcing partners by rendering them a commodity service provider measured on price and SLA criteria. Since all of the ‘value’ has been removed from the outsourced end of the supply chain, a multitude of 3PL or other supply chain providers can be measured equally on their ability to deliver goods accurately and on time for the lowest price possible.

Supply Chain Synchronization

Execution of the final phase in supply chain evolution involves ‘synchronizing the supply chain’ and bringing value back inside the four walls of the organization by controlling the software solutions directing and ultimately being utilized by the commodity components of the supply chain. By allowing 3PLs to retain order and warehouse management components they are also allowed to retain ‘value’ and increase the dependency upon them.

In order to completely own the supply chain value, the CSP should begin ‘synchronizing’ its technology solutions into the supply chain environments. By deploying a net-centric distributed order and eventually, warehouse management solution, a service provider is empowered with complete inventory visibility across multiple 3PL partners, resellers, vendors, distributors and partners anywhere on the globe and reduction of the huge on-hand inventory quantities with just-in-time inventory planning (many CSPs still currently ‘rent’ up to $20MM in capital from a 3PL partner to purchase inventory that the CSP is ultimately responsible for – there is no risk to the partner. The CSP also pays good interest rates to the 3PL for this service) that allows drastic reductions in capital held hostage with 3PL partners because actual inventory numbers are not known, the 3PL partners are not efficient enough and therefore accurate forecasting cannot be planned.

The ability to multi-source fulfillment that this model provides has many other benefits as well:

- No longer dependent upon a single point of failure in the supply chain – multiple sources for fulfillment mean less downtime and backlogs to customers

- Allows organization to push down requirements to it’s suppliers / partners and eliminate those partners that cannot meet organizational standards (Wal-Mart continues to be the leading example of this methodology today)

- Receive ‘commodity’ services from 3PL and carrier partners such as backorder, shipment and delivery notification allowing the organization to make operational decisions based upon that data

- Ability to control the software and associated operating procedures used by supply chain partners thus driving up efficiency and driving down cost to an even higher degree.

Own the Value, Own the Customer, Control Your Destiny

Many communications providers have become dependent on a single CPE outsource solution provider by allowing the control of their customer data and billing events; value components, to be located within their partner’s systems.

Most eventually come to realize that they have essentially become a multi-channel retailer and part of that delivery is dynamically managing visibility and fulfillment of CPE goods across multiple fulfillment partners and organizations that are geographically and systemically diverse.

Inventory synchronization solutions captures, aggregates, and provides visibility to inventory quantities at all locations in a supply network- internal and external.

They provides visibility to and control over all inventories in the network, including in-transit inventory. They increase inventory turnover and supply chain flexibility through global visibility and synchronization of supply. With both overall and granular inventory visibility, an order hub strategy with inventory synchronization powers real-time global ATP, and facilitates accurate, rules-based order fulfillment while synchronizing, and monitoring all inventory levels and movements to ensure identification and resolution of exceptions and anticipation of potential problems. It enables companies to accurately fulfill customer orders while optimizing inventory levels across their business.

Key Capabilities

- Global, Multi-Site Visibility – View inventory at all network locations – whether owned or partners, etc.

- Real-time Available-to-Promise – Provide accurate, global inventory availability in real-time through any order capture or customer interaction environment.

- Network Inventory Monitoring – Gain visibility of all supply and demand across variable time horizons. Monitor net availability positions and establish re-order points and manage back-orders.

- Network Inventory Updates – Receive and update inventory snapshots from individual locations and/or individual adjustments as they occur.

- Flexible Segmentation of Inventory – Easily configure inventory categories and flexibly model your distribution environment.

- Inventory Reservation – Manage inventory against user-defined segments and reserve inventory against quotes or draft orders to ensure commitment.

- Supply Chain Event Management – Flexibly manage exceptions in inventory levels, movements and late receipts; and proactively resolve problems.

- Analytics – Provide reporting and analytics infrastructure for defining, tracking and managing to metrics.

Business Benefits

- Reduce Inventory Levels – Eliminate redundant inventory and improve allocation predictability with global visibility and rules-based sourcing.

- Reduce stock-outs and overstocks – Manage customer demand against a broader and deeper view of inventory and initiate re-orders or markdowns based upon defined triggers.

- Increase revenue – Maximize fill rates for greater revenue capture via global sourcing and rules-based allocation.

- Reduce costs – Optimize spend on inventory storage across the network based on order geography profiles.

- Improve flexibility – Leverage new fulfillment options that reduce costs and inventory levels, without losing control of inventory.

An order hub strategy with distributed order management helps to drive profitable sales growth by successfully managing order fulfillment across the extended supply chain — providing synchronization and control of all internal and external processes tied to order fulfillment. It provides the capability to manage orders from multiple channels and coordinate fulfillment across multiple inventory locations, suppliers, partners and business units. With distributed order management, you can dramatically improve supply chain efficiency, present a single face to customers and adapt to ongoing business evolutions. It makes the increasingly complex fulfillment process transparent and enables your company to harness its full growth potential while driving down supply chain costs.

A flexible, easily configurable process model system for order management and fulfillment automates the manual processes often associated with managing orders in an extended supply chain. Order management addresses the entire order process from order capture to settlement. Each order line easily follows a unique process based upon any order-related attribute or business rule. It automatically creates and tracks any processes that result from, or depend upon, the original customer order. Order management also dramatically reduces order fulfillment costs and significantly improves the quality of customer service.

It resolves the challenges of complex, distributed fulfillment of discrete customer demand, such as quotes, orders, replenish requests, etc. It encompasses all demand-triggered processes across the extended supply chain, such as drop shipping, procure-to-order, delivery and services. Order management enables flexible execution of the customer fulfillment life-cycle from quote and capture to source and fulfill to returns and settlement.

Key Capabilities:

- Order aggregation and global sourcing – Leverage a multi-channel order repository for single source of information, and globally schedule and source orders based upon key business requirements.

- Execute beyond the four walls – Model role-based relationships in the supply chain and coordinate fulfillment activity across all external participants.

- Flexibly control fulfillment activities – Enable customized, line-level order fulfillment based upon any order-related attribute or condition, and adapt to dynamic variations in process.

- Granular management of complex fulfillment – Automatically creates and tracks any order, resulting from the original customer request and manage all associated dependencies.

- Receive inventory updates from external partner systems maintaining enterprise-wide inventory and service visibility.

Business Benefits:

- Reduce Operating Costs – Eliminate manual processes, reduce error rates and exceptions, and efficiently execute distributed order fulfillment.

- Drive Higher Revenue – Scale to meet growth objectives, and improve ability to reach new customers and offer complementary products and services.

- Improve Order Fill Rates – Leverage rules-based sourcing, flexible fulfillment and event management to improve performance.

- Increase Customer Satisfaction – Provide customers with reliable order commitments, increased fulfillment options and real-time order status even across disparate external partner systems.

CSPs should look to an order hub software platform to allow then bring the ‘value’ components of routing logic, carrier/service selection, event and fall-out management, enterprise-wide inventory visibility and billing event control. Additionally order management should maintain the dependencies, state and resolution of all lines of a customer order, from services to delivery to CPE product.

Next time we’ll look at taking value back in the last mile – by owning the software used within the third-party fulfillment provider’s warehouse itself.

NaaS (the Network as a Service). First and foremost the most valuable asset that a provider has beside the mountain of customer data (big data anyone?) is the network itself. CSPs should be looking to unlock their network with lightweight services that can be offered easily and simply to a wide customer base. With the proliferation of software ‘app stores’ independent as well as large developers have created a massive demand for mobile, location and network related activities to make their software work better. Companies like AT&T have already begun to do this with their Network API developer network. The untapped revenue opportunity for an already sunk cost for CSPs is huge in this area and the advent of mobile lightweight devices and cloud-based solutions is making NaaS red hot in 2013.

NaaS (the Network as a Service). First and foremost the most valuable asset that a provider has beside the mountain of customer data (big data anyone?) is the network itself. CSPs should be looking to unlock their network with lightweight services that can be offered easily and simply to a wide customer base. With the proliferation of software ‘app stores’ independent as well as large developers have created a massive demand for mobile, location and network related activities to make their software work better. Companies like AT&T have already begun to do this with their Network API developer network. The untapped revenue opportunity for an already sunk cost for CSPs is huge in this area and the advent of mobile lightweight devices and cloud-based solutions is making NaaS red hot in 2013. BYOD (Bring Your Own Device). CSPs are knows as communications and telephone companies. They also have a large amount of experience in managing and deploying mobile devices on a massive scale. I was at MobileCON this past Fall and BYOD was THE topic of choice for companies out there looking to manage a huge influx of devices from their employees. IBM is now managing over 100,000 BYOD devices for its own employees. However, most companies haven’t got a clue as to how to manage their BYOD problem. This is where the CSP can help. CSPs have a great opportunity to provide this level of service to corporations, universities, school systems and governments. BYOD is coming and will be red hot in 2013.

BYOD (Bring Your Own Device). CSPs are knows as communications and telephone companies. They also have a large amount of experience in managing and deploying mobile devices on a massive scale. I was at MobileCON this past Fall and BYOD was THE topic of choice for companies out there looking to manage a huge influx of devices from their employees. IBM is now managing over 100,000 BYOD devices for its own employees. However, most companies haven’t got a clue as to how to manage their BYOD problem. This is where the CSP can help. CSPs have a great opportunity to provide this level of service to corporations, universities, school systems and governments. BYOD is coming and will be red hot in 2013. Social, Mobile & Personal. For years CSPs have talked about the 360 degree view of the customer and enhanced customer experience but most of them haven’t been able to achieve either one with consistency. CSPs need to start embracing their customers where their customers live – which is increasingly on mobile devices in complex social environments. While social commerce is still struggling to get out of the gate, there is evidence its influence is growing and it will increase throughout the year. Mobile commerce is booming and customer self-service capabilities are becoming table-stakes for CSPs and the ability to support personalized and directed offers for customers is critical for success in the new marketplace. This cannot be accomplished without a focus on customer insight and campaign management capabilities within the organization. Social, Mobile & Personal engagement with customers is going to be red hot in 2013.

Social, Mobile & Personal. For years CSPs have talked about the 360 degree view of the customer and enhanced customer experience but most of them haven’t been able to achieve either one with consistency. CSPs need to start embracing their customers where their customers live – which is increasingly on mobile devices in complex social environments. While social commerce is still struggling to get out of the gate, there is evidence its influence is growing and it will increase throughout the year. Mobile commerce is booming and customer self-service capabilities are becoming table-stakes for CSPs and the ability to support personalized and directed offers for customers is critical for success in the new marketplace. This cannot be accomplished without a focus on customer insight and campaign management capabilities within the organization. Social, Mobile & Personal engagement with customers is going to be red hot in 2013.

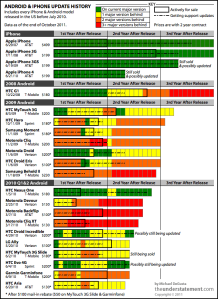

A lot has been said about Apple and Steve Jobs over the past few months and frankly for the past 10 years on their meteoric rise together to stardom. A lot has also been said about Apple’s meticulous adherence to design quality and simplicity over features and hardware specs.

A lot has been said about Apple and Steve Jobs over the past few months and frankly for the past 10 years on their meteoric rise together to stardom. A lot has also been said about Apple’s meticulous adherence to design quality and simplicity over features and hardware specs.